DailyPlay – Opening Trade (CRM) – May 13, 2024

CRM Bearish Opening Trade Signal Investment Rationale Once...

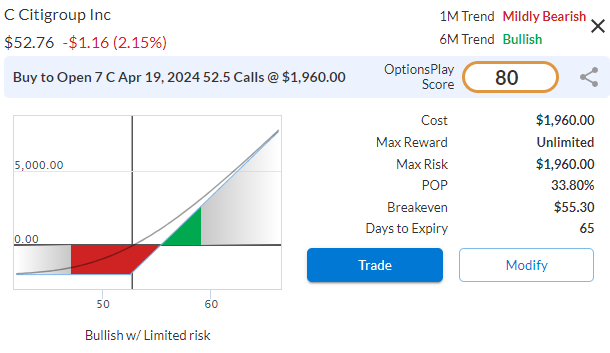

Read MoreCitigroup has been working on a turnaround for nearly 20 years. There has been a revolving door of CEOs, but Jane Fraser has seemed to catch investor’s attention finally. As they shed unprofitable businesses and focus on generating revenue growth, the stock has not underperformed over the last 10 months. Signs that a potential turnaround is starting to take shape, and an opportunity to start adding a small position to a portfolio.

Citigroup has traded within a band of roughly $35 and $80 over the past 12 years, after tumbling 98% after the financial crisis. Its most recent visit to the bottom of the trading range was in Oct of last year. And after clearing above a $52 resistance level, yesterday’s selloff brings us back to this $52 level that now acts as support. Adding a small position provides an extremely attractive risk/reward. A break below $52 would trigger a stop loss and a small amount risked, while our upside target is $68 initially and $80 as extended targets.

C – Daily

The story gets even more attractive when we take a look at valuations. C currently trades at only 0.6x book value, while its peers typically trade at twice or three times that. Additionally, I am quite comfortable as an investor buying into a bank that is trading at 7x forward earnings. I feel a lot more confident that there will be less likely to be a significant downside with such rock-bottom valuations.

C Trade Details

Strategy: Long Call

Direction: Bullish Calls

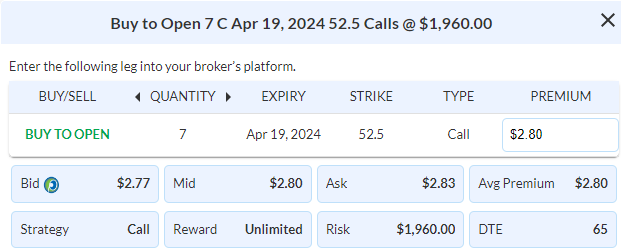

Details: Buy to Open 7 Contracts April 19th $52.50 Calls @ $2.80 Debit per contract.

Total Risk: This trade has a max risk of $1,960 (7 Contracts x $280) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $280 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is trading in a bullish trend and is expected to bounce higher from this level.

1M/6M Trends: Mildly Bearish/ Bullish

Relative Strength: 9/10

OptionsPlay Score: 80

Stop Loss: @ $1.40 Credit. (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

CRM Bearish Opening Trade Signal Investment Rationale Once...

Read More

DailyPlay Portfolio Review Investment Rationale As buyers...

Read More

Investment Rationale As AI-related stocks such as META,...

Read More

Investment Rationale As equity markets rally back above its...

Read More

Share this on