DailyPlay Portfolio – January 29, 2024

DailyPlay Portfolio Review DailyPlay Update Welcome to our...

Read MoreTrack all your live options accounts and create a paper trading account with OptionsPlay’s new Portfolio feature! As the #1 most requested feature, we built a way for anyone to add positions to a portfolio and edit and track them in one place on our platform, including paper trades. In this post, I will walk you through setting up your portfolios and adding/editing positions to them.

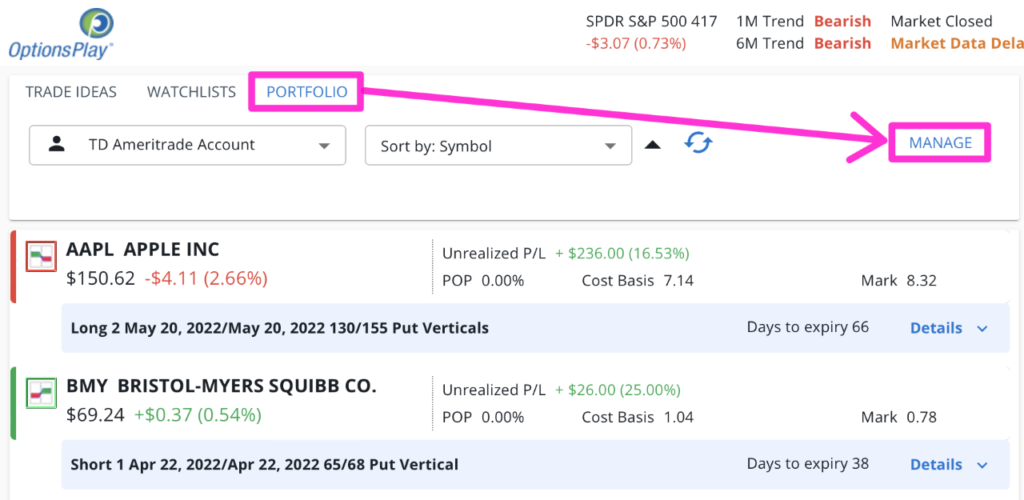

Start by creating your portfolios by clicking on the Portfolio Tab on your OptionsPlay platform and selecting “Manage”.

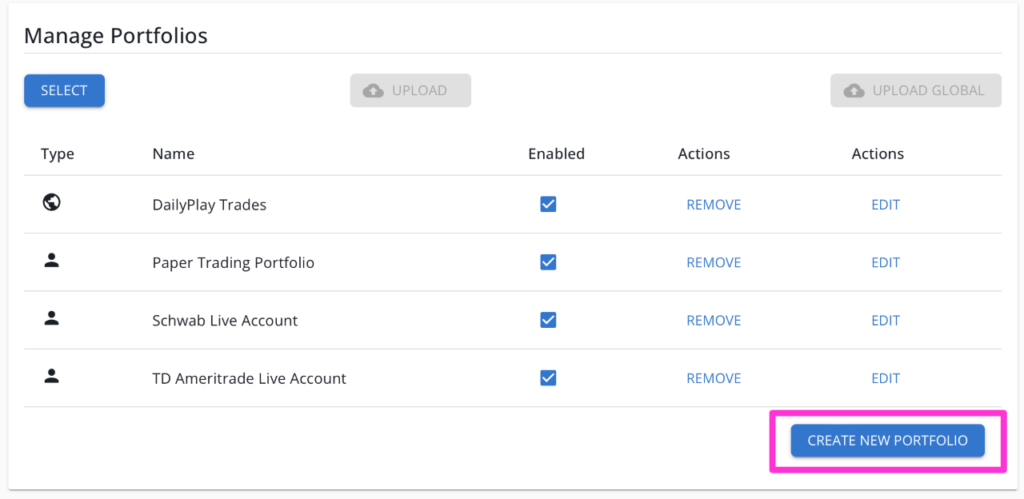

Click on the “Create a New Portfolio” button at the bottom to add a new portfolio. I recommend creating a separate portfolio for each of your live options accounts and one for a paper trading portfolio to test new strategies and trades.

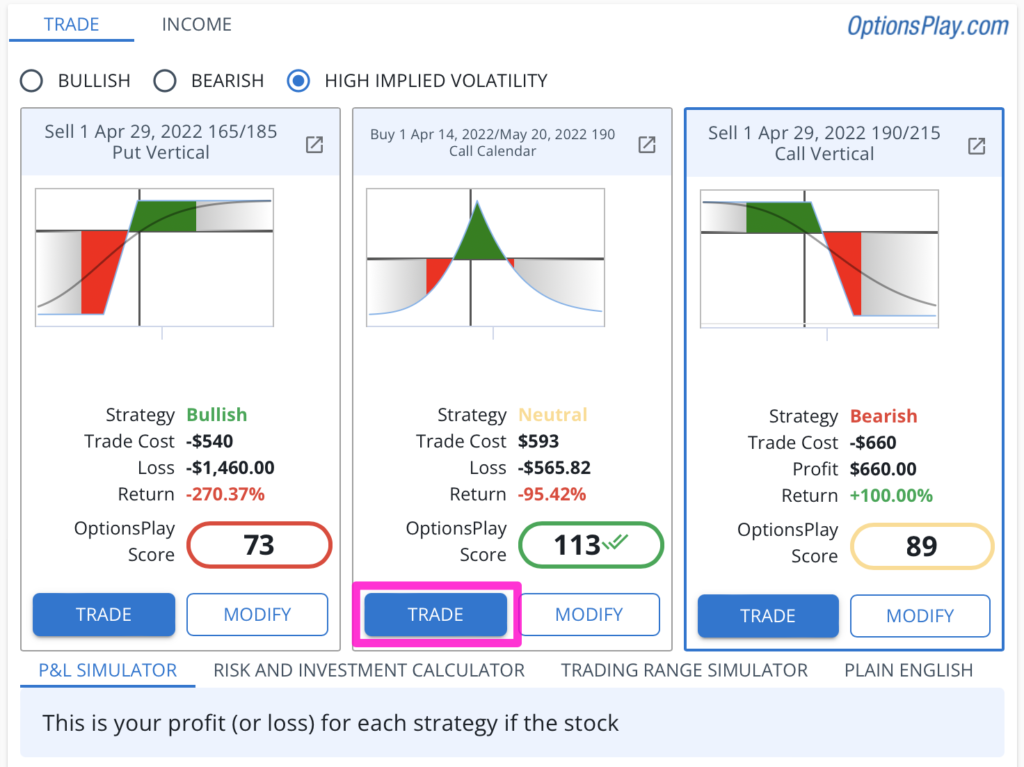

Once your portfolios have been created, you can enter positions by staging the trade-in OptionsPlay and clicking on the “Trade” button.

Simply select the portfolio that you want to add the position to at the bottom of the page and click “Add Position”.

’

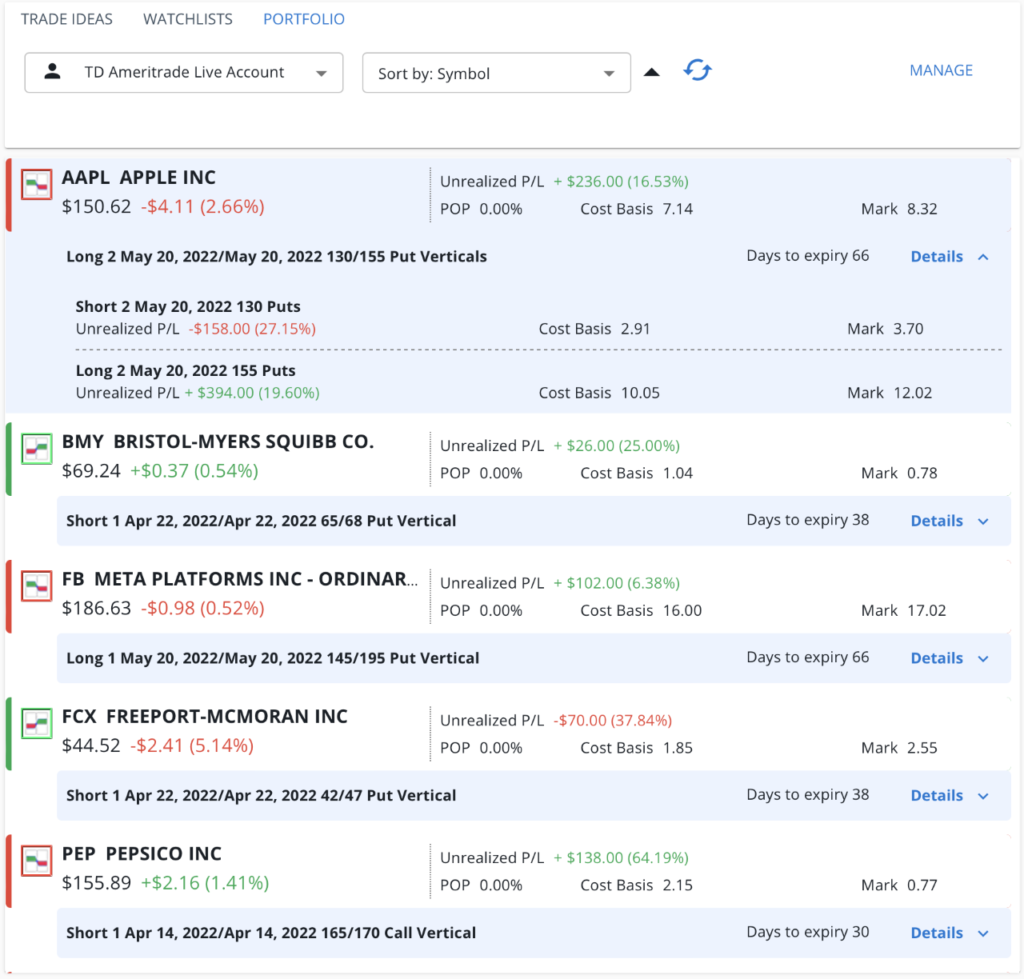

Once a position has been added to a portfolio, clicking the Portfolio Tab, and selecting a specific portfolio allows you to see the positions in that portfolio. You can track the Total P&L of each net position and P&L % with the P&L of the individual legs.

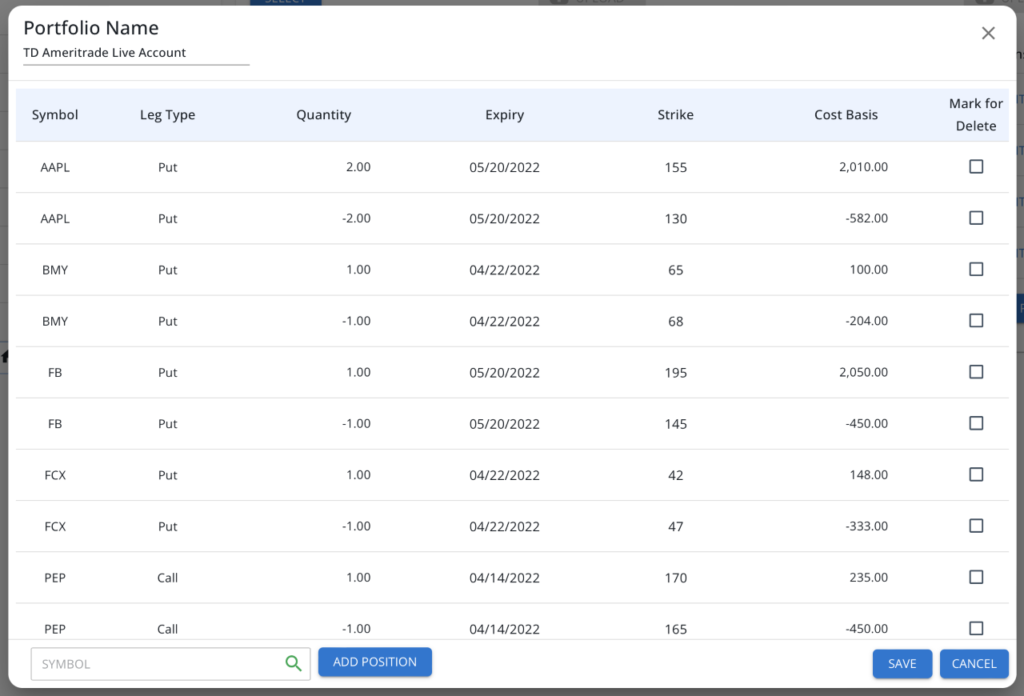

Positions can be edited and deleted using the “Manage” button at the top of the Portfolio Tab. By selecting the Edit button on any of the portfolios. You can change the quantity (positive for long, negative for short) and cost basis (positive for long, negative for short) of each position. To delete a position, select the position to delete and click “Save” to complete your changes to the portfolio.

For example, if you purchased 4 Contracts of an option at $2.00, enter a cost basis of $800. If you sold 2 Contracts of an option at $1.50, enter a cost basis of -$300.

I hope that this guide provides you with a clear understanding of how to utilize OptionsPlay’s new Portfolio tool. We hope that you’ll be able to use it to track your real portfolios and test out new positions with a paper trading portfolio to learn and explore new options strategies. Please let us know if you have any questions or feedback by contacting your customer success representative or contact our team at [email protected].

Learn more about our new user experience and watch now!

Tony Zhang

Chief Strategy Officer

DailyPlay Portfolio Review DailyPlay Update Welcome to our...

Read More

Closing Trade Investment Rationale As we continue to...

Read More

EBAY Bullish Opening Trade Signal View EBAY Trade...

Read More

OptionsPlay is making changes to our DailyPlay signals and...

Read More

Share this on