What is a Cash Secured Put?

A cash secured put is simply selling a put option while setting aside cash to buy the stock in the case of assignment. This is slightly different from selling a naked put option where the writer of the put hopes that price does not decline. The cash secured put is primarily considered to be a stock acquisition strategy but can also be an income generating strategy. As this strategy involves receiving a premium for selling a put option, the investor can generate a consistent income with this strategy. However, due to high downside risk, other income-generating strategies such as credit spreads provide better risk profiles.

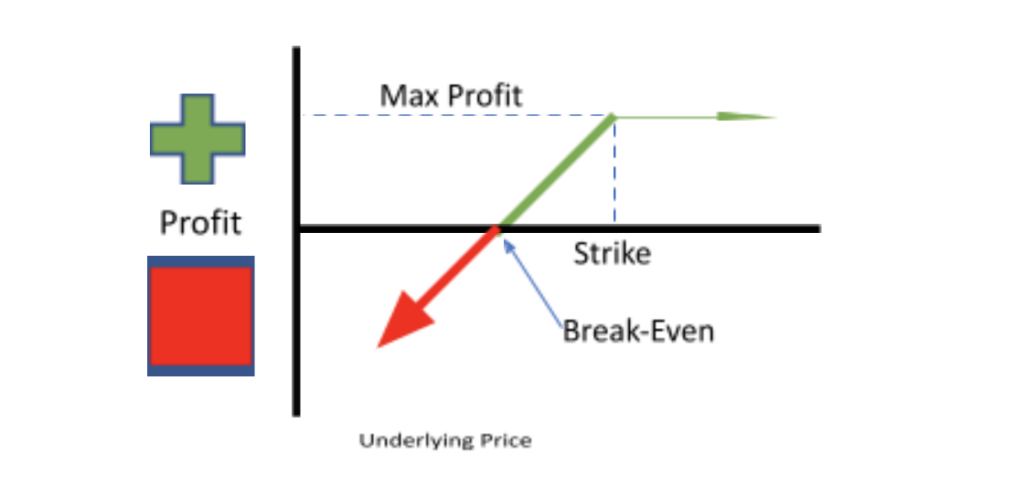

Payoff Diagram for Cash Secured Put Strategy

This payoff diagram is identical to that of the naked put strategy. The key difference between these two strategies lies in the intention of the investor. A naked put strategy is a cash generating strategy where the investor only wants to profit from the premium received and hopes that the option is not exercised. A cash secured put strategy allows for the shares to be bought using the cash put aside and hopes that the option is exercised as it allows the investor to buy the stock for a lower price.

What is the Motivation for Cash Secured Puts?

The motivation behind selling Cash Secured Puts is usually to acquire the stock at a lower price than its current price. For example, if $XYZ stock was trading at $100 and an investor shorted 1 $XYZ 98 put for $2 per share, the investor would need to buy the stock in the event that the option is exercised. If the investor shorted a naked put option instead, the above scenario would be seen as a negative outcome as the intention of the investor was to profit from receiving the premium and not having to buy the shares. However, in this case, the intention of the investor using the Cash Secured Put strategy is to acquire shares at a lower price, and instead of originally having to buy $XYZ stock at $100, the investor can buy them at $98. This also allows the investor to use the premium received to net the total cost of buying the shares at the strike price. The overall effective cost of buying each share is therefore reduced to $96 ($98 strike – $2 premium received).

This seems like a win-win situation for the investor. If the market price rallies, the investor profits from the premium received, and if the price drops, the investor gets to purchase shares cheaper. However, there are situations where this strategy will not work. If the stock price were to plummet to $50 instead of having a short-term retracement, the investor would have a loss of $39 per share. In the worst case, if the stock price declines to zero, the maximum loss for this strategy is $96 per share. It is also important to consider the case of $XYZ stock not retracing and immediately rallying. Although the investor receives a premium and is in a profitable position, the investor loses the opportunity to buy $XYZ stock at 98 and instead would have to consider buying at a higher price.

Buy Limit Order vs. Cash Secured Put

Consider the example below:

| Outcome | Enter Buy Limit @ $100 | Sell Oct $98 Put @$2 |

| Stock moves higher | Unfilled Order | Keep $2 premium, repeat again |

| Stock goes below $100 | Own stock at $100 | Own stock at $96 ($98 strike – $2 premium received per share) |

| Stock goes to $0 | $100 Loss | $96 Loss |

| Executes immediately | Typically, only executes at expiration |

In all 3 outcomes, Selling Cash Secured Puts provides a better risk profile than that of a Buy Limit Order.

Top Strategy?

The ideal outlook for this strategy is that the stock has a short-term retracement before continuing a longer-term rally. Investors should have a neutral/slightly bullish short-term view while having a bullish long-term view. Having a short-term bullish view is not ideal for this strategy as the retracement may take longer than expected.

Best Practices and Tips

There are 2 things to consider before implementing a cash secured put strategy:

- Time to expiration – Due to time decay (theta), options lose value the closer they get to expiry. Options with shorter expirations lose value quicker than those of further expirations. However, as this strategy involves selling a put, theta works in favor of the seller of the contract. The writer of the option should consider short-term options (typically 4-7 weeks).

- Strike Price – When choosing a strike price, it is better to take a more aggressive approach. As this strategy is a stock acquisition strategy, investors would want the option to be exercised even if they are short of the put option. Picking a strike price closer to the current price increases the premium received and decreases the probability of the option expiring worthless.

Summary

This strategy works best for investors looking to acquire the stock at a cheaper price than the current market price. This strategy supports a “short-term bearish but long-term bullish” outlook. By shorting a put and setting aside cash to buy the stock if the put is exercised, investors can take advantage of short-term retracements in long-term trends of a stock. While the strike price and time to expiration are dependent on the risk tolerance of the investor, short-term options with strike prices close to the current price are more ideal for this strategy.

Share this on